2025 Closed with a Record: 1.35 Million Sales — What's Next?

Turkey's automotive market closed 2025 with 1.35 million units sold — a new all-time record. That's roughly 10% growth year-over-year. What kept demand alive? Relative stability in exchange rates, poor returns on traditional investments, and the classic "prices will go up" mentality. People parked their money in cars.

EVs reached nearly 18% market share — ahead of many European countries. SUVs approached 65% of total sales. Diesel dropped below 10%; just a few years ago it was 80%. Industry leaders are cautious about 2026: ODMD Chairman Ali Haydar Bozkurt expects a year "slightly below the record." Credit conditions and tax burden will be the deciding factors.

January 2026 started strong: 75,362 total units sold, beating expectations. Passenger cars grew 9.14%, light commercial vehicles 12.56%. Renault led with 8,649 units, Toyota second with 7,770. The Clio topped the model rankings again with 4,556 units.

China's Wind in Turkey: BYD Leads, Chery Heads to Samsun

Chinese brands are now an undeniable force in Turkey. In 2025, 11 Chinese-origin brands were active in the market. BYD alone sold 45,537 units, capturing the lead in the plug-in hybrid and new energy vehicle (NEV) segment. All this without producing a single car locally.

The $1 billion Manisa factory project remains a mystery. Presidential-level agreements were signed in 2024, a 150,000-unit capacity facility was planned, but on the ground there are just two power transformers. The Hungary plant is progressing fast while Manisa stays silent. The topic has reached parliament — opposition MPs are questioning where the incentives went. The Ministry says "no cancellation, process continues" but there's no concrete progress either.

The second wave comes from Chery. A $1 billion investment in Samsun was announced: 200,000 annual capacity, plus an R&D center, with over 5,000 jobs planned. Chery will compete directly with BYD through its Fulwin lineup. Turkey's customs union with the EU makes it an attractive export gateway to Europe for Chinese manufacturers. In January alone, Chery already sold 2,257 units.

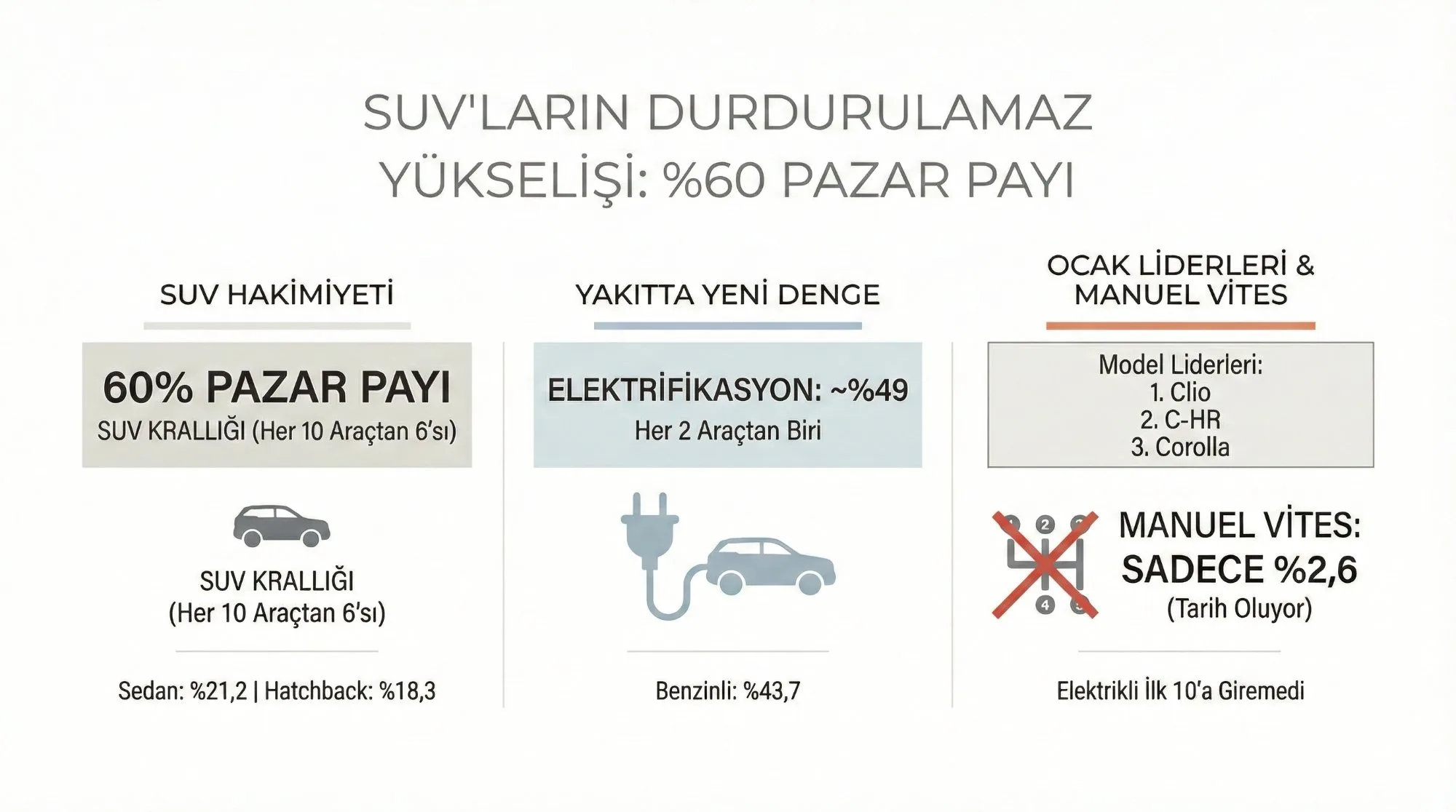

The Unstoppable Rise of SUVs: 60% Market Share

January data makes it crystal clear: 6 out of every 10 cars sold is an SUV. 60.3% market share — SUVs are the undisputed king. Sedans dropped to 21.2%, hatchbacks to 18.3%. Sad news for sedan lovers, but the market has spoken.

The fuel mix is also shifting. Gasoline still leads at 43.7%, but hybrid + electric combined reached 49%. Nearly every other car sold has some form of electrification. Manual transmission is practically extinct at just 2.6%. Automatic owns 97.4%.

By model, the Renault Clio led with 4,556 units. Toyota C-HR (hybrid) came second at 3,200, Corolla third at 2,351. The top 10 includes 4 hybrid models, but notably no fully electric model made the cut — despite 11,304 EV sales, the volume is spread across too many brands and models.

Togg T10F on the Road, T8X on the Horizon

Togg closed 2025 with a record 39,020 units sold. January saw 2,029 sales to kick off the new year. The T10X has proven itself in the C-SUV segment — 5 stars from Euro NCAP, continuously improving via OTA updates.

The real excitement is the T10F hitting the roads. This sporty fastback sedan enters a new segment for Togg, offering 623 km range in its long-range version — beating many rivals in its class. February prices were held steady with zero-interest financing campaigns continuing.

All eyes now turn to the T8X. CEO Gürcan Karakaş described it as a "smaller sibling" of the T10X and confirmed it will launch within 2026 — ahead of the original timeline. The T8X will take Togg into a more affordable segment, potentially opening the brand to a much wider audience.

Let's talk automotive

Feel free to reach out about industry trends or collaboration.